Banks provide vital services to citizens, businesses, and the economy at large.

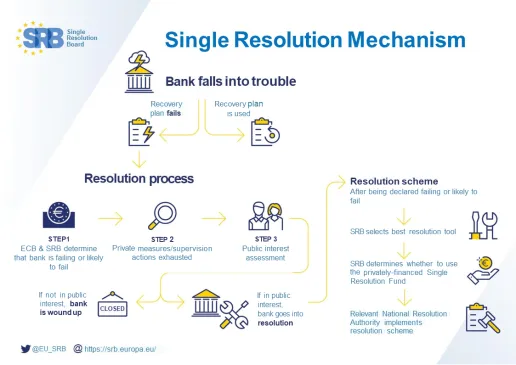

In the past, because of the vital role played by banks, and in the absence of effective resolution regimes, authorities have often had to put up taxpayers' money to restore trust and avoid a contagion effect of failing banks on the rest of the economy.

In view of the critical intermediary role that banks play in our economies, financial difficulties in banks need to be resolved in an orderly, quick and efficient manner, avoiding undue disruption to the bank's activities and to the rest of the financial system.

While for most banks this can be achieved through the normal insolvency proceedings applicable to any company in the market, some banks are too systemically important and interconnected to allow for their liquidation through a normal insolvency process.

Rather than relying on taxpayers to bail these banks out, a mechanism is needed to put an end to potential domino effects. It should allow public authorities to distribute losses to banks' shareholders and creditors – rather than on the taxpayers.

In most bank crisis cases, normal insolvency proceedings will be applied. Resolution applies when this would be in the public interest, safeguard financial stability, and protect taxpayers. Generally, this happens when normal insolvency proceedings would inflict damage on the real economy and cause financial instability.