Single Resolution Mechanism

Page

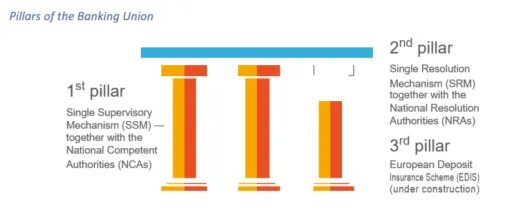

The Single Resolution Mechanism is made up of the Single Resolution Board and the National Resolution Authorities in Eurozone countries, Bulgaria and Croatia

Cooperation

Page

The SRB works closely with Banking Union, European and internal authorities.

Addressed questions

Page

In line with the Single Resolution Mechanism Regulation, the SRB is accountable to the Council, the European Parliament and the Commission. Furthermore, the Board is required to reply to questions addressed to it by the European Parliament and [...]

Administrative Contributions

Page

Although the SRB is an independent EU agency, it is not publicly funded. Instead, banks operating across the Banking Union must pay an annual levy towards the running costs of the SRB.