*All figures and documents available in this section reflect the situation as of the day the Master Decision on the calculation of the 2022 ex-ante contributions (decision SRB/ES/2022/18 of 11 April 2022) was adopted.

Each year, pursuant to Article 70(2) of the Regulation (EU) No 806/2014, the Single Resolution Board determines the annual ex-ante contributions to be raised from institutions within its scope. In this section, please find further information on the 2022 ex-ante contribution cycle and, in particular, on the target level, institutions in scope, the risk adjustment factor, the consultation procedure and the ongoing litigation.

Target level and amount to be collected

- When setting the target level for 2022, the SRB took into account, as it does every year, the requirements as prescribed by the applicable legal framework, i.e. (expected) growth of covered deposits, business cycle, impact on the financial position of institutions, the obligation to spread evenly the contributions throughout the initial period and the obligation to reach the final target level at the end of the initial period (31/12/2023) (Article 69 Regulation (EU) No 806/2014).

- The historical data suggests a constant growth trend during that period in the covered deposits of all credit institutions in the Member States participating in the Banking Union. Covered deposits have displayed high levels of growth in 2020 and in 2021. In particular, in 2021 the average amount of covered deposits, calculated quarterly, of all credit institutions in the participating Member States amounted to EUR 7126 billion[1]. This figure represents a growth of 6.5% vis-à-vis the yearly average of covered deposits calculated on a quarterly basis reported by the DGSs in 2020.

- According to economic forecast available at the time of the Decision, euro area real GDP growth is set to remain subdued in Q1-2022 due to persistent supply disruptions, higher energy prices and the conflict in Ukraine. Economic growth is expected to pick up from Q2-2022 as a number of negative factors are likely to fade gradually, even though this increase is partially offset by the negative effects of the conflict in Ukraine.

- The Board concluded that it is reasonable to expect continued firm growth in covered deposit levels in the Banking Union over the remaining two years of the initial period, i.e. a growth rate at 5%. This is in line with what has been observed over the course of that initial period from 2016-2021 in terms of average growth (5.1%) and median growth (4.8%)

- Taking into account all the above factors, the SRB adopted a conservative approach with regard to the range of growth rates of covered deposits over the coming years until 2023 and set the total amount of contributions to the SRF for the 2022 ex-ante contribution period (the “annual target level”) at 1/8th of 1.6 % of the covered deposits (calculated quarterly) of all credit institutions authorized in the participating Member States in 2021, which translates into an amount of EUR 14.253.573.821,46. This represents an increase of 26% compared to the 2021 ex-ante contributions. The growth in ex-ante contributions is attributable to the increase in the annual target level, while the risk profile of the Institutions, as measured by the Risk Adjustment Factor, on average remained unchanged between 2021 and 2022.

- The total amount of the ex-ante contributions that will be collected by the SRB in June 2022 amounts to EUR 13,67 billion. This amount takes into account the deduction of the 2015 ex-ante contributions and the impact of data restatements and revisions.

[1] The data provided by the Croatian DGS was, prior to being sent to the Board, converted from Croatian Kuna in euro by the Croatian DGS by applying the conversion rate as published by the ECB on 31 December 2021. The data provided by the Bulgarian DGS was, prior to being sent to the Board, converted from Bulgarian lev in euro by the Bulgarian DGS by applying the fixed conversion rate published by the Bulgarian National Bank (Fixed exchange rate of 1 EUR = 1,95583 BGN).

Institutions in scope

- In 2022, 2896 institutions are in the scope of the SRF (down slightly from 3 018 in 2021). The decrease in the number of institutions is mainly due to further market consolidation and/or loss of banking license.

- The institutions in scope of the SRF could be split further in the following three categories:

- 43% are small institutions eligible for a lump sum contribution under Article 10 and mortgage institutions under Article 11 of the Commission Delegated Regulation (EU) 2015/63;

- 26% are risk-adjusted institutions (that pay 97% of the total amount to be collected) under Article 5-9 Commission Delegated Regulation (EU) 2015/63; and

- 31% are medium institutions (institutions whose total assets are more than EUR 1 000 000 000 equal to, or less than, EUR 3 000 000 000) that are in scope based on Article 8(5) Council Delegated Regulation (EU) 2015/81 and whose contributions consist partly in a lump sum and for the rest are calculated in accordance with the risk-adjusted methodology.

- The distribution of the burden for payment of the 2022 ex-ante contributions did not change significantly compared to 2021 ex-ante contribution cycle. The 20 largest contributors at group level represent 68% of the total 2022 ex-ante contributions, the same share as in 2021, 2020 and 2019 ex-ante contribution cycles.

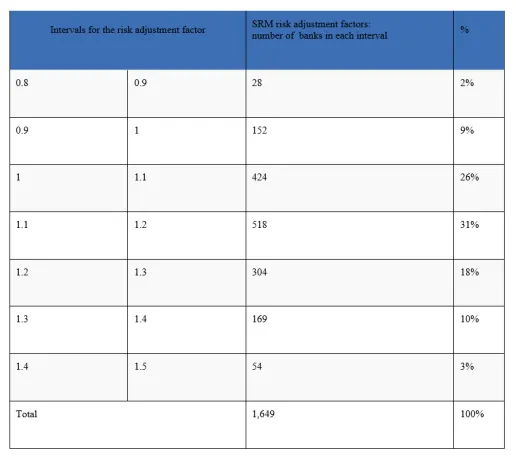

Risk adjustment factor in the euro area

The table above shows for the 2022 contribution period the distribution of the risk adjustment factors, computed and rescaled over the range between 0.8 and 1.5 in accordance with Article 9(3) of Commission Delegated Regulation (EU) 2015/63:

- 11% of the risk-adjusted entities (180 institutions) are classified with a risk adjustment factor between 0.8 and 1;

- the risk adjustment factor for 75.5% of the risk-adjusted entities (1 246 institutions) ranges from 1 to 1.3;

- 13.5% of the risk-adjusted entities (223 institutions) are classified with a risk adjustment factor ranging from 1.3 to 1.5.

Consultation procedure

- In 2022, the SRB provided institutions with the possibility to comment on the main elements of the ex-ante calculation decision. The consultation procedure, which was firstly introduced during the 2021 cycle, further enhances transparency and makes the decision making process more robust from a procedural point of view. A dedicated consultation platform was made available to institutions to facilitate the review of the documents consulted on and the submission of comments.

- As a novelty for the 2022 contributions period, the consultation phase also included the preliminary calculation decisions on restatements of data used in previous contribution cycles.

- The consultation process itself was launched on 3 March 2022 and closed on 17 March 2022. Institutions were provided with:

- a preliminary draft of the main body of the decision on calculation of contributions for the 2022 cycle; and

- preliminary calculation results: common data-points and the provision of bin thresholds provided visibility on the binning process and allowed for the accurate estimation by the institutions of their individual contributions while yet respecting confidentiality requirements.

- A total of 60 institutions participated by providing comments on 14 different topics. The most commented topics were Target Level and Calculation Methodology, followed by Irrevocable Payment Commitments and Calculation Results. The majority of comments was received in English (83.3% of the submissions), the next language used for submissions was German (10% of the submissions). The Member States with the majority of the submissions were France 48.3% and Germany 25.0%. All the comments received where carefully considered by the SRB and were comprehensively addressed in the 2022 ex-ante calculation decision, in particular Annex III.

Launching the 2022 ex-ante contributions cycle

The Single Resolution Board (“SRB”) announced the start of the 2022 ex-ante contributions cycle for the calculation and collection of ex-ante contributions to the Single Resolution Fund (“SRF”).

As always, the first phase of the cycle is the collection of data pertaining to the institutions under the obligation to contribute to the SRF, which is used to determine their 2022 ex-ante contributions. The SRB has provided the 2022 Data Reporting Form and the related documentation to the National Resolution Authorities (“NRAs”), which are in turn distributed the data collection package to the institutions under their remit.

For an overview of the key steps and the preliminary timeline of the 2022 ex-ante contributions cycle, you can consult the 2022 cycle Kick-off letter (link below).