Bail-in implementation

Page

Operational guidance on bail-in implementation, guidance on bail-in for international debt securities and the Minimum Bail-in Data Template

Operational continuity in resolution and FMI contingency plans

Page

Guidance to banks on how to implement SRB expectations.

Guidance on liquidity and funding in resolution

Page

Guidance on how to implement the SRB's expectations.

Notification of impracticability to include bail-in recognition clauses in contracts

Page

SRB approach and expectations.

Brexit UK Instruments Communication

Page

SRB approach to the eligibility of UK law instruments without bail-in clauses after Brexit.

SRB approach to prior permissions regime

Page

Permission for reducing eligible liabilities instruments

Operational guidance for banks on separability for transfer tools

Page

Operational guidance for banks on separability for transfer tools

Guidance on solvent wind-down

Page

Guidance on solvent wind-down of derivatives and trading books in resolution

Operational guidance on the identification and mobilisation of collateral in resolution

Page

Operational guidance on the identification and mobilisation of collateral in resolution

Operational Guidance on Liquidity in Resolution

News

The guidance document targets the liquidity dimension of the SRB’s previously issued “Expectations for banks” aiming at enhancing banks’ resolvability

Related news and press releases

Press releases

|

Today, the SRB has published a document for banks, investors and other stakeholders on executing its bail-in decision, as well as links to national...

Press releases

|

This will include expectations on valuation data and playbooks.

Consultation to be carried out in 2025.

The Single Resolution Board is developing and...

News

|

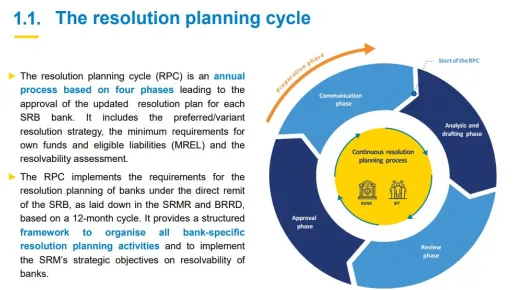

Find out more about the SRB’s 2024 resolution planning cycle (RPC) in our new publication. The SRB launched the RPC for banks under its remit in April...